This FD is Offering Up To 9.6% Annual Interest; Check Revised Fixed Deposit Rates Of This SFB

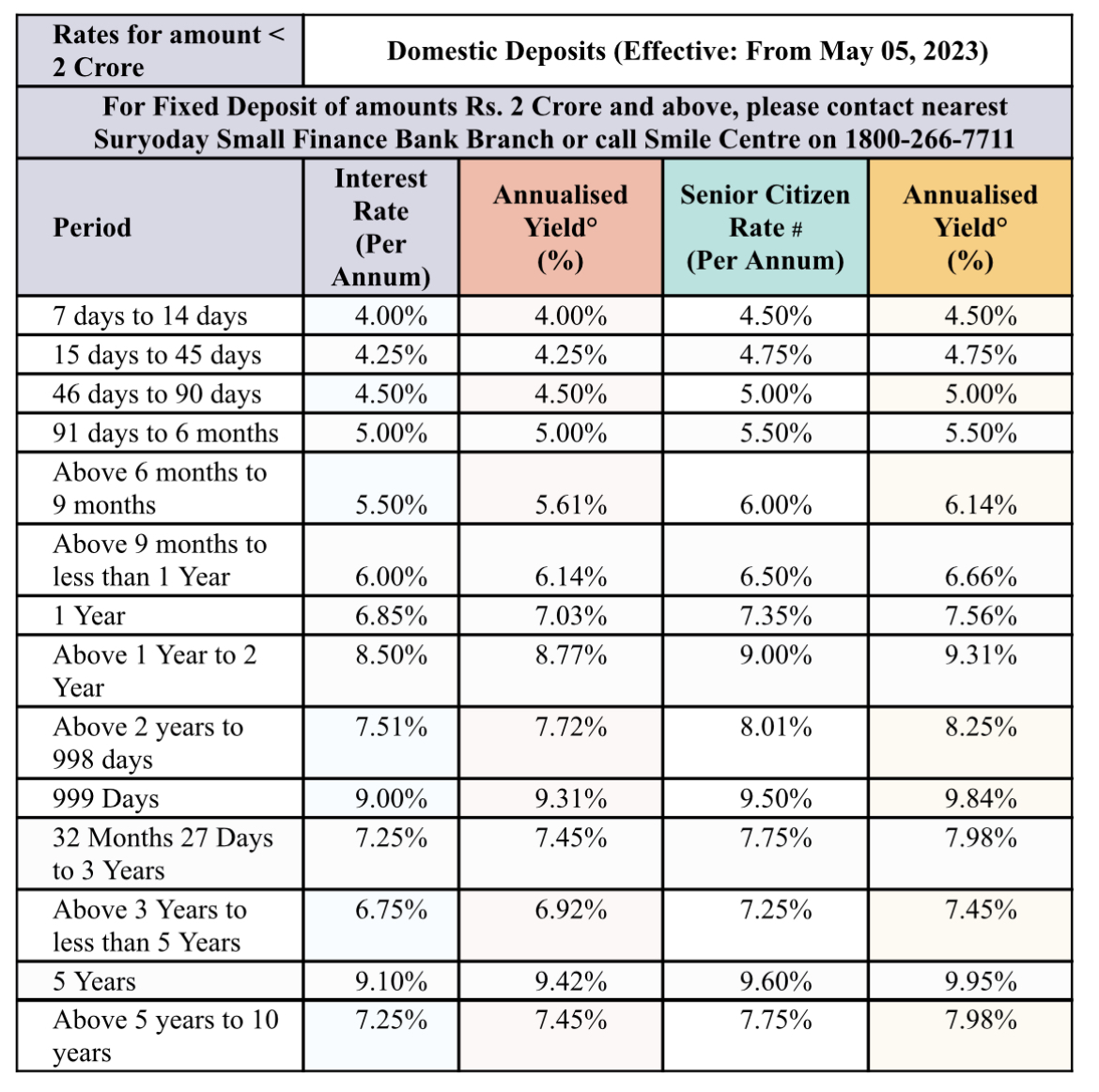

Suryoday Small Finance Bank is now accepting FDs of less than Rs 2 crore maturing in 7 days to 10 years at an interest rate of 4 per cent to 9.10 per cent to the general public and 4.50 per cent to 9.60 per cent to senior citizens.

Also Read– Paytm Narrows Loss in January-March of FY23 to Rs 167.5 Crore

Suryoday Small Finance Bank (SSFB) has revised interest rates on it fixed deposits (FD), effective Friday, May 5, 2023. Interest rates on deposits of less than Rs 2 crore with 1 to 5-year tenure have been revised upwards by 49 to 160 basis points (bps). After the latest hike, the bank is now accepting fixed deposits of less than Rs 2 crore maturing in 7 days to 10 years at an interest rate of 4 per cent to 9.10 per cent to the general public and 4.50 per cent to 9.60 per cent to senior citizens.

“Regular customers can now get 9.10 per cent interest rate on 5-year deposit, while senior citizens can get a 9.60 per cent interest rate. The bank is also offering interest rate up to 7 per cent to its savings account customer in above Rs 5 lakh up to Rs 2 crore slab. This is the highest interest rate that the bank offers to its customers, also your deposits are backed by DICGC in this bank, making an investment decision soon will result in addressing your mid-term goals of 5 Years,” Suryoday Small Finance Bank said in a statement.

Also Read– How Much Does It Cost To Print Indian Currency Notes?

It said, “The minimum tenure for earning FD interest is 7 days. The rate applicable on premature withdrawal would be 1 per cent less than the rate applicable from the lower of the two — the rate for original /contracted tenure for which the deposit has been booked (as on the date of booking the deposit); the rate for the actual tenure for which the deposit was in force with the Bank (as on the date of booking the deposit).”

Also Read : How to increase your chances of getting approved for a home loan? Check details

The bank also said that as interest rates are subject to change without prior notice, depositors shall ascertain the rates on the value date of FD.

Comments

Post a Comment