Step-by-Step Guide to Apply and Download e PAN Card

The Income Tax Department has introduced a new initiative called e PAN card (electronic PAN). It is a digital version of the traditional PAN card, which can be used for financial and tax-related transactions. Users can instantly obtain an e-PAN card by applying online, with an Aadhaar card mandatory due to an Aadhaar number being required for e-PAN issuance. Individuals already possessing a PAN are not eligible for a e PAN card apply. Also, ePAN cannot be obtained by company or LLP or partnership firm. This article helps you learn how to apply for and download an e PAN card online (NSDL, UTIISTL & income tax e-filing portal) and offline.

IndiaFilings helps you to apply for a ePAN card with expert assistance!!

Eligibility to Apply for an ePAN card

To engage in the process of e PAN card apply with Aadhar, you must fulfil the following requirements,

- Indian Residents: You must be a resident of India to be eligible.

- Individual Taxpayers: This applies to individuals, not entities like companies or Hindu Undivided Families (HUF).

- No Existing PAN: You cannot apply for an e-PAN if you already have a regular PAN card.

- Aadhaar Card Holder: You must possess a valid Aadhaar card with an updated and correct details.

- Linked Mobile Number: Your Aadhaar card must have a registered and active mobile number.

How to Apply for an e PAN Card via Income tax e-filing portal?

The following steps have to be followed for the process of e PAN card apply with Aadhar:

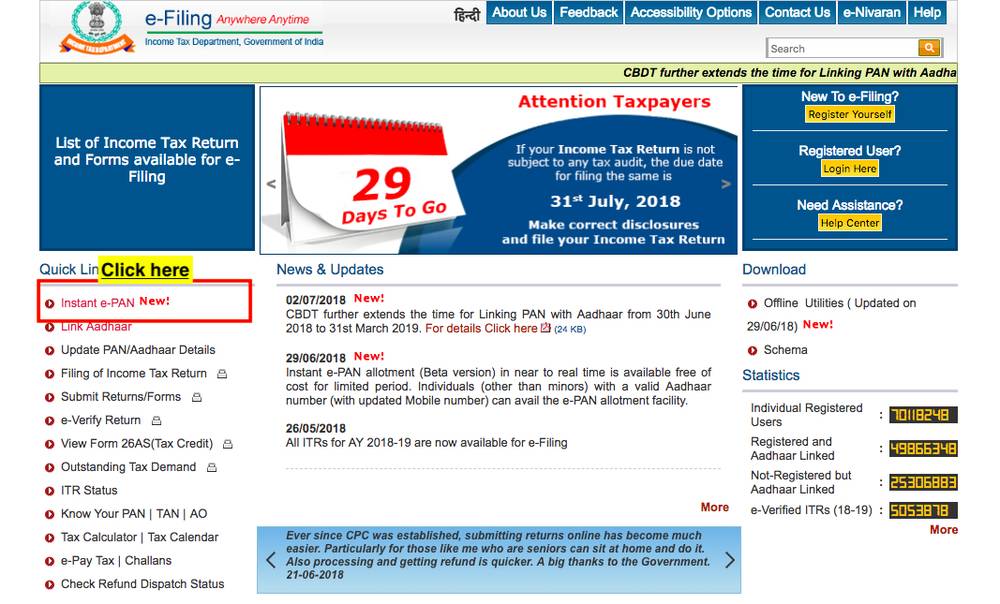

Step 1: Log on to the website

The applicant has to log on to the income tax India e-filing website.

Step 2: Mobile number linked to Aadhar

The applicant has to possess the registered mobile number that is linked with the Aadhar card.

Step 3: Click on Instant e-Pan

The applicant has to click on Instant e-Pan option.

Step 4: Enter the details

In the Aadhar e-KYC, the applicant has to enter the details as registered in the Aadhar card and the Aadhar Number.

Step 5: Enter the OTP

Once, the Aadhar number is entered, an OTP will be sent to the registered Mobile number.

Step 6: Uploading the signature

The applicant has to upload the scanned copy of the signature on a white paper with a resolution of 200 DPI, with a file type of JPEG of 10 KB with a dimension of 2×4.5 cm.

Step 7: Acknowledgement Number

Once all the details are entered correctly, the applicant will receive a 15 acknowledgement number to the registered mobile number.

To check the status of the ePAN card, the following steps have to be followed:

Step 1: Log on to the website

The applicant has to log on to the income tax India e-filing website

Step 2: Click on Check Instant e-Pan Statuts

In this page, the applicant has to enter the 15 digit acknowledgement number.

Step 3: Knowing the Status

Once the acknowledgement number is submitted, the applicant can view the status of the e-Pan card.

How to Apply for an e PAN Card on the NSDL Portal?

Use the following steps to process the ePAN apply online through the NSDL Portal.

Step 1: Visit the Protean eGov PAN portal and click’ Paperless PAN application’ in the ‘Online PAN services’ section. This will take you to a page where you can apply for a New PAN.

Step 2: Select “New PAN – Indian Citizen (Form 49A)” under “Application Type”.

Step 3: Choose “Individual” for the “Category”.

Step 4: Fill in all the required details exactly as per your Aadhaar Card.

Step 5: While making the application, select “No” for the question “Whether Physical PAN Card is required?”. This ensures you receive only the e-PAN.

Step 6: Upload the necessary documents as specified during the application process.

And Pay the required fees.

Step 7: You’ll receive an acknowledgement number on your email or mobile. Use this number to track the application status.

Step 8: Once your PAN is allotted, the e-PAN will be sent directly to the email address you provided in the application.

How to Apply for an e PAN Card through UTIITSL Portal?

The following steps can be used to complete the ePAN apply online through UTIITSL Portal.

Step 1: Visit the UTIITSL PAN portal

Step 2: Click on “PAN Card” and then select “New PAN Card” or “Apply for PAN” depending on the available options.

Step 3: Under the PAN services, select the option ‘PAN Card for Indian Citizen/NRI’. Choose the Form 49A to apply for a New Card.

Step 4: Select “e-PAN only” or a similar option when asked about receiving a physical card (this might vary slightly depending on the portal’s interface).

Step 5: Fill in the required details exactly per your Aadhaar Card.

Step 6: Upload the necessary documents as specified during the application process. (These might include scanned copies of your Aadhaar card, address proof, etc.). And Pay the required fees.

Step 8: You’ll receive a 15-digit acknowledgement number on your email or mobile number. Use this number to track the application status.

Step 9: Once your PAN is allotted, the e-PAN will be sent directly to the email address you provided in the application.

How to Download an ePAN Card using the Income Tax e-filing site?

If you obtained your e-PAN card recently using the Instant PAN card feature with Aadhaar, you can use the following steps to download it on the income tax e-filing website.

Step 1: Visit the Income Tax e-filing website:

- Go to the income tax filing website.

Step 2: Access Instant e-PAN Section:

- There are two possible ways to access the Instant PAN Card (e-PAN) section:

- On the homepage: Look for a section or link related to “Instant e-PAN”. This might be displayed prominently or under a menu like “Services”.

- Search bar: If you don’t see a clear link, use the search bar on the website and type “Instant e-PAN” or “Download e-PAN”.

Step 3: Check Status/Download PAN:

- Once you’ve located the Instant e-PAN section, navigate to the option for “Check Status/ Download PAN”.

Step 4: Enter Aadhaar Details:

- Provide your 12-digit Aadhaar number in the designated field.

- Click “Continue”.

Step 5: Verify with OTP:

- An OTP (One-Time Password) will be sent to the mobile number registered with your Aadhaar.

- Enter the received OTP in the designated field on the website.

- Click “Continue”.

Step 6: View Status and Download e-PAN:

- The website will display the status of your e-PAN application.

- If your e-PAN has been allotted, you’ll see a “Download e-PAN” option.

- Click on “Download e-PAN” to save your e-PAN card in PDF format.

How to Download an ePAN card on the NSDL Portal?

The NSDL portal allows you to download an e-PAN only if it was recently allotted (within the last 30 days) after the completion of the ePAN apply online. Here’s how to download it:

1. Check Eligibility:

- Ensure your PAN was allotted within the last 30 days.

2. Visit the NSDL Portal:

- Go to the NSDL e-PAN website

3. Choose Download Option:

- Depending on the allotment timeframe, select one of these options:

- Download e-PAN card (For PAN allotted in last 30 days) – This is free for the first three downloads.

- Download an e-PAN card (For PAN allotted older or more than in the last 30 days) – This incurs a fee.

4. Enter Details:

- Provide the required details:

- PAN number

- Date of birth (Month and Year)

- GSTN (Optional)

- Enter the captcha code.

5. Get and Enter OTP:

- Choose how you want to receive the One-Time Password (OTP): Email or Mobile Number (or both).

- Click “Generate OTP” and enter the received OTP in the designated field.

6. Download e-PAN:

- Upon successful validation, you can download your e-PAN in PDF format.

How to Download e PAN Card from UTIITSL Portal?

Follow these steps to download the ePAN Card from the UTIITSL Portal.

Step 1: Visit the UTIITSL Portal:

Go to the UTIITSL PAN card download webpage. You can find it in the search engine itself.

Step 2: Enter Your Details:

You will be required to enter the following information:

- PAN Number: Enter your 10-digit PAN number.

- Date of Birth/Incorporation: Provide your date of birth in the format MM/YYYY. If you’re not an individual applicant, enter the relevant date based on your entity type (e.g., Date of Incorporation for a company).

- GSTIN (Optional): If you have a GSTIN number, you can include it here.

- Captcha: Enter the characters in the image to confirm you’re not a bot.

Step 3: Submit and Receive Link:

Once you’ve filled in all the details, click the “Submit” button. If everything is correct, a link will be sent to the registered email address and mobile number associated with your PAN.

Step 4: Download Your e PAN Card:

Open the link you receive. You might be prompted to enter a one-time password (OTP) sent to your mobile number or email for verification. Enter the OTP to proceed. You can download your ePAN card directly from the provided link upon successful authentication. The downloaded file will be in PDF format and password-protected.

Note:

- The password to open your ePAN card PDF is your date of birth/incorporation, as entered in the application form (format DDMMYYYY).

- If your ePAN was issued within the last month, you can download it for free. After that, a fee of Rs. 8.26 (including taxes) applies for each download request.

How to Apply for a PAN Card Offline?

Here’s how to apply for a PAN card offline in India:

Step 1: Download the Application Form:

- Visit the NSDL e-Gov website and download Form 49A, the application form for a PAN Card.

Step 2: Fill out the Form:

- Carefully fill out the application form with all the required information as per the instructions provided.

Step 3: Attach Photograph and Signature:

- Affix a recent passport-size photograph on the application form in the designated space.

- Sign the application form in the designated area.

Step 4: Submit the Form and Documents:

- Along with the completed form, you must submit supporting documents as proof of identity, address, and date of birth (if applicable). The documents accepted may vary, but commonly accepted ones include an Aadhaar card, voter ID card, passport, driving license, utility bills, and bank account statements.

- Submit the form and documents at any NSDL/UTIITSL office or a PAN facilitation centre. There might be an associated service fee for using these centres.

Step 5: Pay the Fees:

- You will need to pay the processing fee for the PAN card application. The fees can be submitted through cash or demand draft.

Step 6: Receive Acknowledgement and Track Application:

- Once you submit the application, you will receive an acknowledgement number. You can use this number to track the status of your PAN card application online.

Get expert support for your ePAN card application from IndiaFilings!!

Other Articles Related to PAN

- How to Apply for a Company PAN Card in India?

- Instant PAN Card Apply with Aadhar

- Know your PAN card

- Lost PAN card

- PAN Card Cancellation

- Multiple PAN Card Issue

- PAN card name change procedure

FormLLC delivers fast, easy U.S. company formation backed by clear guidance and strong support, helping entrepreneurs launch and manage their businesses confidently.

ReplyDeletehttps://formllc.co.in/

FormLLC.us streamlines business formation through clear steps, fast processing, and dependable assistance at every stage of the U.S. setup journey.

ReplyDeletehttps://formllc.us/

These products feel thoughtfully developed and easy to incorporate into daily life. Pure Canna Organics keeps quality and simplicity front and center.

ReplyDeletehttps://purecannaorganic.com/